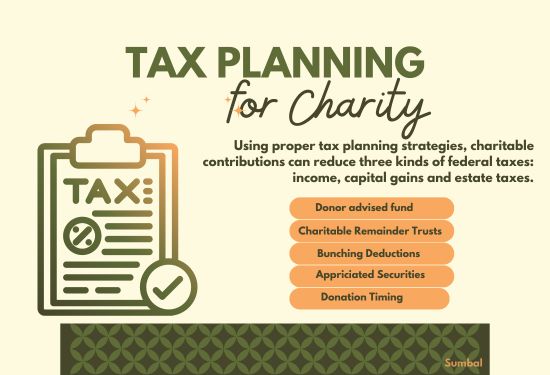

People also need to know that giving away their money to charities can be a way of maximizing their tax deductions. This means that one can schedule his donations in a way that will benefit both the inviter and the donor and the organizations that benefit from the donations. The following article examines the different techniques you can use to fund non-profit organisations and maximise your tax savings.

Why Charitable Donations Offer Tax Advantages

Charitable giving in the USA has always been promoted through different provisions of the Internal Revenue Code. Also, by donating to a qualified organization, you can offset your income in this way, making the income being charged with taxes smaller. These deductions are also helpful for individual taxpayers or any business that wants to do some philanthropy while also trying to pay their taxes.

Key Tax Strategies for Charitable Giving

The following are some of the best ways you can sharpen your giving power:

1. Donating Appreciated Assets

The most common type of tax-reducing strategy is to contribute securities that have been held for the long term or other property such as stocks, bonds or real estate. If you contribute these assets, you do not pay taxes for the appreciation of value but you get an exact poor deduction of their fair market value. This may exceed up to 30% of your adjusted gross income ( AGI ) to avoid paying the 20% capital gains tax that would have been due on the sale of the actual assets and yet lower your income tax.

2. Bunching Deductions

The standard deduction limits have been set high since the 2017 tax reform, and thus, most filers do not claim itemized deductions. However, “clustering” multiple years’ worth of charitable donations to exceed the standard deduction would be beneficial in itemizing that particular year. You use that in the following years and can return to claiming the standard deduction again.

3. Donor-Advised Funds

A DAF is a charitable account that enables you to contribute assets to a public charity and receive an immediate charitable deduction, then recommend grants to charities as you wish over time. This kind of structure provides the added advantage of building the funds tax-free and choosing when you will make the donation, where it will be made and who will benefit from it. DAFs offer an initial tax deduction but allow deciding when to distribute the money, making it an excellent option for those with a long-term donation plan.