Interest rates play a pivotal role in shaping the dynamics of the real estate market. Whether you're a seasoned investor or a first-time homebuyer, understanding how fluctuations in interest rates affect real estate investments is crucial. This article delves into the current trends and future predictions regarding interest rate changes and their impact on real estate investments.

Current Trends in Interest Rates and Real Estate

Over the past decade, interest rates have experienced significant fluctuations. Following the 2008 financial crisis, central banks around the world, including the Federal Reserve in the United States, adopted historically low-interest rates to stimulate economic growth. These low rates made borrowing cheaper, leading to a surge in real estate investments as both investors and homebuyers took advantage of favorable mortgage conditions.

However, in recent years, the trend has shifted. Central banks have started to gradually increase interest rates in response to economic recovery and rising inflation. This shift has begun to impact real estate markets in various ways:

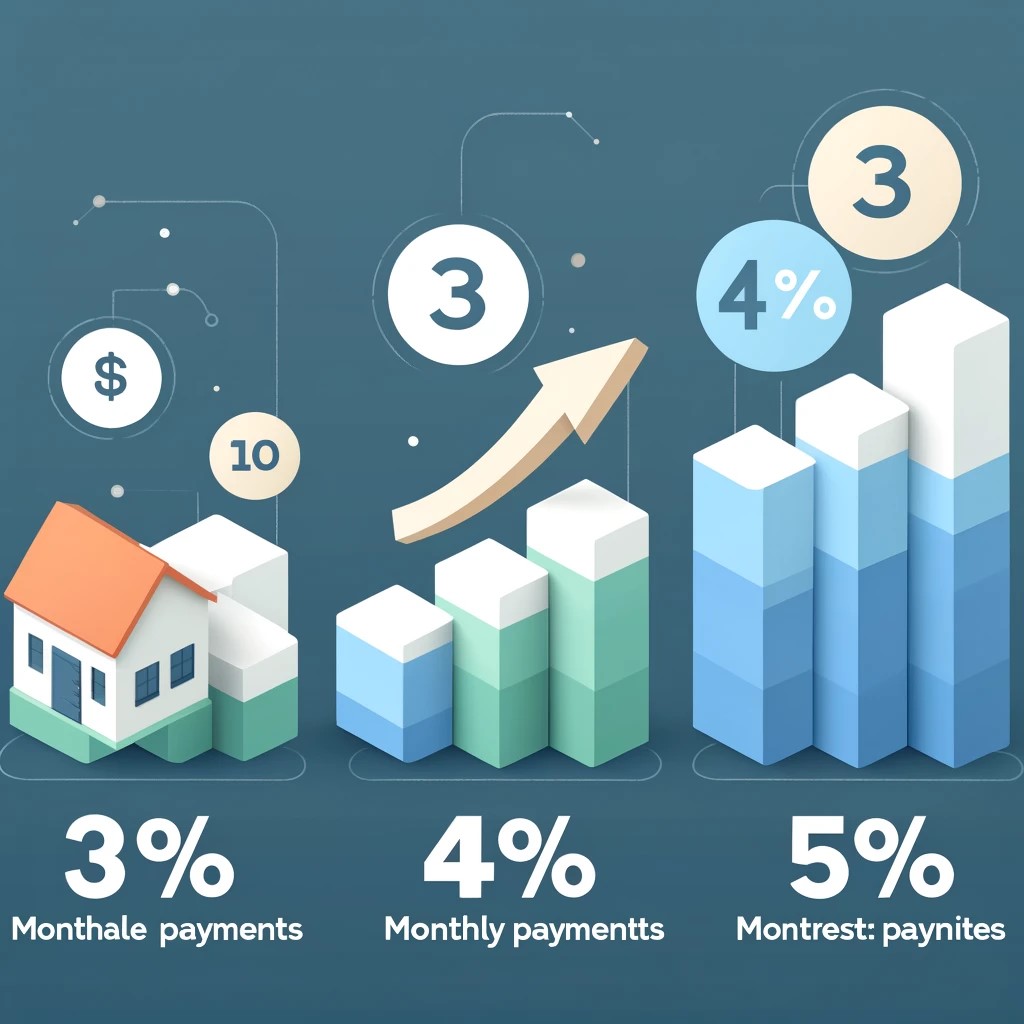

Cost of Borrowing: Higher interest rates increase the cost of borrowing. For investors, this means higher mortgage payments, which can reduce cash flow and overall return on investment (ROI). Homebuyers face similar challenges, as higher rates can decrease affordability and reduce demand for homes.

Impact on Different Real Estate Sectors

The impact of interest rate changes is not uniform across all real estate sectors. Let's explore how various sectors are affected:

Residential Real Estate: Residential properties are highly sensitive to interest rate changes. Higher rates can deter potential homebuyers, leading to slower sales and price stagnation. Conversely, lower rates can boost affordability and drive up demand, leading to increased sales and higher property values.

Real Estate Investment Trusts (REITs): REITs, which pool investor money to purchase and manage income-producing properties, can be sensitive to interest rate changes. Higher rates can lead to higher borrowing costs for REITs, impacting their profitability and dividend payouts. However, REITs can also benefit from inflationary environments if property values and rental incomes rise.

Future Predictions

Looking ahead, several factors will shape the impact of interest rate changes on real estate investments:

Technological Advancements: Technology continues to revolutionize the real estate industry. From digital platforms for property transactions to advancements in construction techniques, these innovations can help offset some of the negative impacts of rising interest rates by reducing costs and increasing efficiency.

Demographic Shifts: Changes in demographics, such as aging populations and urbanization, will influence real estate demand. For example, an aging population may increase demand for senior housing, while urbanization could drive demand for residential and commercial properties in city centers.

Conclusion

Interest rate changes have a profound impact on real estate investments, influencing borrowing costs, property values, and investment strategies. By staying informed about current trends and future predictions, investors can make more informed decisions and navigate the complexities of the real estate market. As the economic landscape evolves, the ability to adapt to changing interest rates will remain a key factor in successful real estate investment strategies.