Investing and purchasing life insurance are connected to financing needs, but their requirements and purposes differ. Let's make the right decision and invest our earned money only in the most profitable sectors.

Understanding Life Insurance

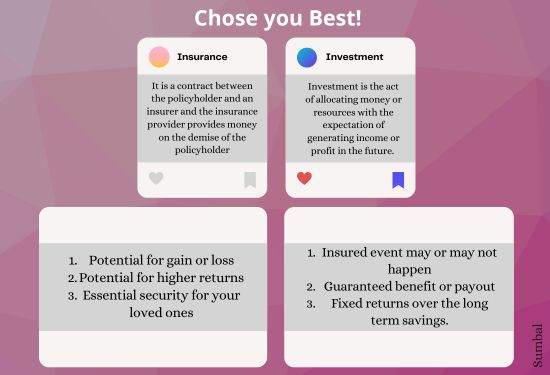

It’s a financial planning necessity for anyone who has dependents and financial obligations such as loans. It gives funds to your dependents when you pass away. Term life insurance covers an insured individual for a set amount of time, but whole life insurance has savings for the insured person's entire lifetime. Term life insurance is also cheaper than the former but has no cash value at the end of each term. The cash value may be withdrawn or utilized as a loan in certain situations, although charges are associated with both.

Understanding Investments

Investments generate wealth designed to increase money. They make incomes for future objectives such as retirement, establishment, or education. Common securities are stocks, bonds, mutual investment funds, and real property. Although they are riskier than life insurance, investments provide higher long-term returns. They are appropriate for those with disposable income, some measure of tolerance for risk, and long-term financial objectives.

Which is Best?

A mix of investing and life insurance is advised by certain financial consultants. While investments can gradually increase wealth, term life insurance can protect against the chance of death.

The answer to the question of whether a life insurance policy or investing money is best, let's explore:

If You Have Dependents

Life insurance is optimal for individuals who are a single or essential family supporter or have dependents like children or a spouse. They will have financial security if you die. People with neither dependents nor serious commitments might not require life insurance as much.

If You Want to Build Wealth

Savings through investments remain essential in achieving long-term primary financial objectives such as wealth creation or accumulation and early retirement, among others. Only if you want to secure your monetary status in the future can investments be a tool to help you grow your money.

Consider a Balanced Approach

In other words, many financial gurus encourage people to invest in life insurance policies. For instance, they recommend buying inexpensive term life insurance and saving for a well-diversified investment, as they are all ways of gaining financial security and wealth. Whole life insurance that contains aspects of both is possible, but the method of separating insurance and investment is sometimes cheaper than that of whole life insurance.

Conclusion

Insurance and investments are vital and play two separate but significant functions in planning for the future. While the first is to safeguard the income and standard of living of your family in case you meet an untimely death, the latter is all about creating assets to cater to future requirements, needs, and wants. A balanced financial strategy covers known events and those that are unforeseeable in equal measure. Bring more focus towards your individual situation, family members, goals, and feelings towards risk to make the right balance for later life.